Growth obtained through short-term tactics eventually plateaus. It’s a dead end.

TL;DR: if you don’t take extreme risks, even if you’re the most skilled person, you will be outperformed by someone who did. And if you take extreme risks, you will have worse average outcomes than if you didn’t (competing for the first place often means using strategies that reduce your average outcome).

…

A recent tweet made me reflect on extreme performers and what we can learn from them. I begin by examining Elon Musk and later move to general principles to choose risk profiles aligned with our needs.

First of all, let me clarify that I agree both with Taleb (most of Musk’s wealth is due to luck) and with Musk’s fans (Musk is very skilled).

In fact, the two are not at odds: Musk is probably both very skilled and very lucky. Skill is sufficient for becoming wealthy, but given that one is wealthy, how wealthy depends a lot on luck. It’s easy to imagine that in many parallel universes, Musk is also a very successful billionaire, but with how many billions? One, twenty, a hundred? It would still be less than half of his wealth in the current universe. The difference, which makes up for much of his present fortune, must be due to luck.

Similarly, skill is sufficient for becoming rich, but becoming the richest man on Earth also requires a lot of luck. Let me justify this statement with a thought experiment. Imagine taking a thousand entrepreneurs, all with the same starting conditions (cash, connections, etc.) and only differing in skill. Then, let’s observe how their wealth evolves in a few decades. As expected, we would notice that, in general, the more skilled a person, the wealthier they became. And yet, if you took the wealthiest one amongst them, the chances that he is also the most skilled one are slim. It’s more likely that the richest person is almost as skilled as the most skilled one but considerably luckier.

My point is not about whether Musk deserves his wealth – I couldn’t care less. Instead, my point is about reproducibility. We often wish to imitate the person with the highest score assuming they are also the most skilled, whereas the most skilled person is more likely to be found among those with a high-but-not-highest score.

Note that I wrote “more likely.” There may be someone so skilled that he ends up with the highest score. But he must be that much more skilled than everyone else. Otherwise, the chances are that one of the “great-but-not-best” participants will get enough luckier than the best one to overcome the difference in skill.

That said, my point is not “don’t imitate the best one” or “imitate the second-best one.” Instead, it’s “be critical about whose strategies you aim to imitate and why.”

Ask yourself, how reproducible is that strategy? In ten parallel universes, in how many do they end up as successful as in this one, and in how many do they end up bankrupt or in jail? Are you okay with not only the outcome in the current universe but also with the full range of outcomes across universes?

Moreover, consider another point Taleb made. “You get to the tail by increasing the variance (or the scale) rather than raising the expectation.” In other words, to get extreme outcomes, you must reduce average outcomes. Do you really want to be the one with the highest score? It will come at a cost. Not just effort and opportunity costs but also risk – risk that will increase the best outcome but decrease the average outcome.

Let me explain this last point with another thought experiment. Again, let’s take a thousand entrepreneurs, all with the same starting conditions (money, connections, etc.) and only differing in skill. Five hundred of them take extreme risks, whereas the other five hundred only take small risks. Let’s observe what would happen after a few years in ten parallel universes. We would notice that, in all universes, the wealthiest entrepreneur would come from the risk-taking group. However, and this is the key point, in each of the ten universes, it would be a different person! Each of these ten people would have extreme success when lucky and terrible outcomes when unlucky. In contrast, a skilled person who only takes moderate risks would have great-though-not-extreme outcomes in almost all parallel universes.

If you don’t take extreme risks, even if you’re the most skilled person, you will be outperformed by someone who did. And if you take extreme risks, you will have worse average outcomes than if you didn’t.

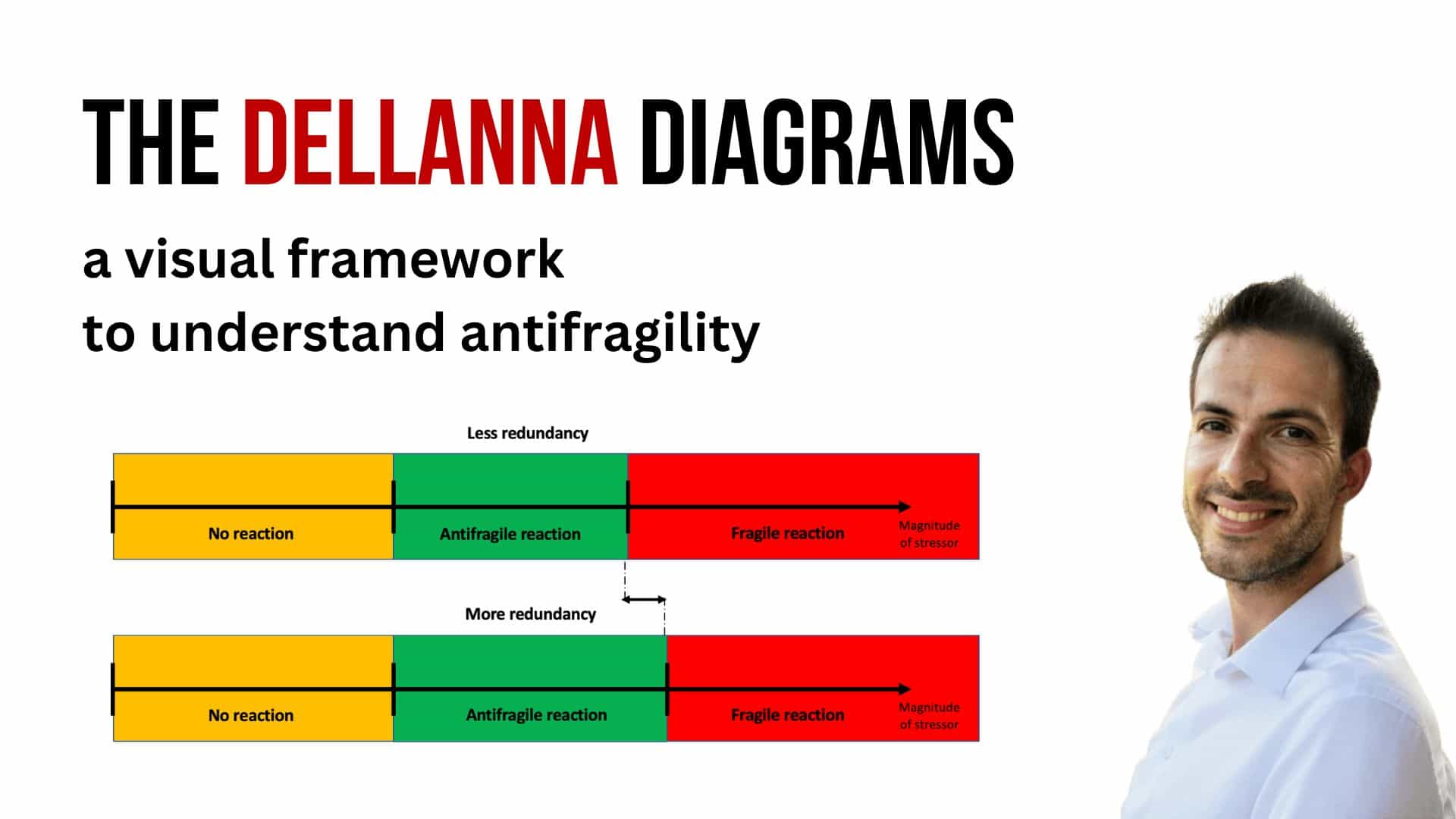

Let me clarify a couple of things. First, this doesn’t mean that you shouldn’t take risks – here, we’re talking about extreme risks, bets that damage you irreparably when they go wrong. In general, taking small risks is a good strategy.

Similarly, this doesn’t mean that you shouldn’t take extreme risks. Instead, it means acknowledging that competing for the first place often means using strategies that reduce your average outcome. Then, the choice of whether to aim for the first place is yours.

And if you really want to become the best, I suggest restricting the scope of “the best at what.” For example, aiming to become the best singer in your town rather than the best artist in your country. Not only does a smaller number of competitors make it easier to win, but it also increases the chances that the winner is the most skilled rather than the luckiest one – in other words, it increases the possibility that a reproducible strategy can lead to victory (because there are fewer chances that someone gets so lucky to overcome the difference in skill with the most skilled person). This is advantageous because it means you can have a strategy that lets you win and has relatively high outcomes even if you’re unlucky.

An addition, as of November 2022: the FTX crash and it’s CEO’s Sam Bankman-Fried (SBF) quick rise-and-crash from little to billions to nothing is another example of the principles described in this article. If you take extreme risks, you will have worse average outcomes than if you didn’t. As Nassim Taleb noted, “SBF got temporarily rich because he is both aggressive and clueless about finance.”

And the fact that SBF overshadowed other more honest and conservative crypto exchange owners is another example of the principle, “if you don’t take extreme risks, even if you’re the most skilled person, you will be outperformed by someone who did.”