Ergodicity in Investing: Why Most Portfolio Advice Is Wrong

Why survival beats returns, and how ergodicity explains position sizing, diversification, and Buffett's first rule.

Published: 2025-12-21 by Luca Dellanna

#ergodicity#investing#portfolio#risk-management#kelly-criterion

Warren Buffett’s first rule of investing is “never lose money.” His second rule? “Never forget rule number one.”

Most people interpret this as obvious advice. But understanding ergodicity reveals why it’s actually the most profound insight in investment strategy.

The tale of two skiers

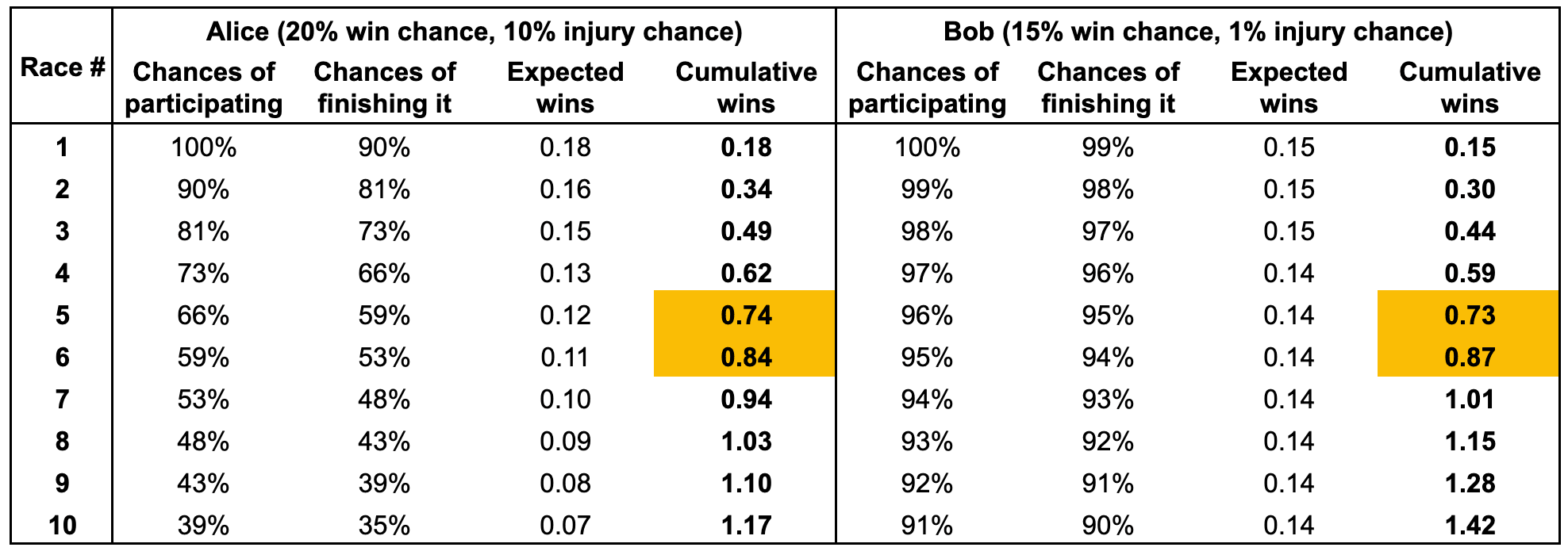

Imagine two cousins who both love skiing, Alice and Bob, who decide to participate in a skiing championship. They have the same skill level and fitness, but with one difference. Alice takes more risks, so she has a 20% chance of winning each race and a 10% chance of injuring herself. Conversely, Bob is more risk conservative, so his chances of winning each race are lower, 15%, but his chances of injury are also lower, 1%. Which skier wins the most races?

The counterintuitive answer is that it depends on the length of the championship! As you can see from the table below, Alice’s strategy is better for championships of up to 5 races, whereas Bob’s is better for championships of 6 or more races.

Want to experience this yourself? Try the Skiing Ergodicity Game to see how small risks compound over time.

Don’t imitate winners

In the previous example, we compared one Alice vs. one Bob, and concluded that Bob’s strategy is better for championships of 6 or more races. But what if, instead, we compared 100 Alices vs. 100 Bobs?

In that case, it’s likely that the racer with the most wins after 10 races would be an Alice, even if on average, Bobs have more wins.

The winner’s strategy is not always the best strategy. Careful who you decide to imitate.

The non-ergodic nature of investing

Markets work similarly to skiing.

- A 50% loss requires a 100% gain to recover

- A 90% loss requires a 900% gain

- At -100%, no amount of future gains can help you

This asymmetry means survival trumps performance.

Further reading

- Ergodicity vs Expected Value - why the math of averages misleads us

- My book on Ergodicity - practical frameworks for any domain

- Ergodicity Economics - the academic foundations